Aura Liquidante:

Decode Market Behavior Using Aura Liquidante Intelligence

Sign up now

Sign up now

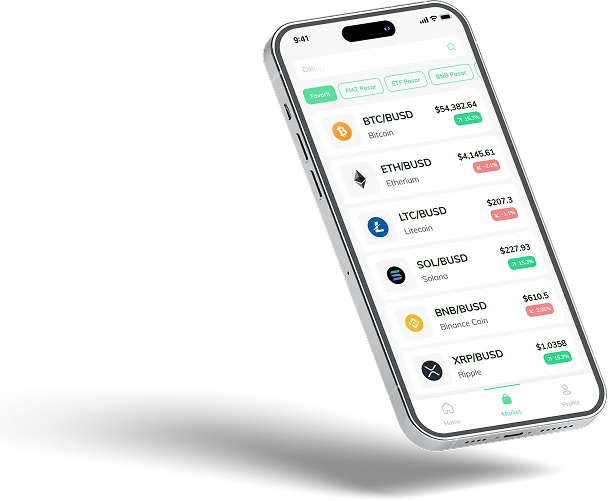

Aura Liquidante applies advanced artificial intelligence and machine learning to observe crypto market behavior as it unfolds. Instead of reacting to obvious price movement, the system evaluates liquidity shifts participation changes and momentum balance to surface early structural signals that are often hidden within raw data streams.

To reduce unnecessary noise, Aura Liquidante activates alerts only when predefined analytical conditions align. This approach keeps attention directed toward meaningful developments rather than constant fluctuations. Market context is organized clearly allowing users to interpret evolving conditions with clarity and control.

When directional pressure strengthens or reversals begin to form, Aura Liquidante categorizes these transitions through structured analysis layers. Continuous monitoring supports disciplined evaluation in fast markets. Cryptocurrency markets are highly volatile and losses may occur.

Instead of relying on delayed indicators, Aura Liquidante evaluates price movement at the moment conditions change. Rapid expansions sudden contractions and shifts in order behavior are analyzed instantly and converted into clear structured insight. Historical clutter is removed so attention remains on forces actively influencing the market. This focused perspective transforms unstable movement into understandable directional awareness.

Rather than responding to visible price noise, Aura Liquidante examines instability at its origin. Pressure buildup structural tension areas and acceleration strength are measured to organize chaotic movement into meaningful intelligence. Each insight provides context around significance and timing allowing decisions to remain grounded in logic. Cryptocurrency markets are highly volatile and losses may occur.

As conditions shift, Aura Liquidante adjusts continuously by tracking engagement changes reaction speed and layered confirmation logic. Complex data is refined into clear guidance without dependence on lagging tools. Only validated signals are surfaced to reflect authentic live market behavior.

Aura Liquidante applies expert designed analytical frameworks that adapt to varied trading approaches while maintaining disciplined structure. The platform does not place or manage trades and remains focused on delivering informed insight rather than execution. Each framework integrates validated market inputs configurable logic layers and ongoing performance visibility. Risk awareness progression tracking and historical condition analysis are incorporated to encourage rational assessment.

Aura Liquidante operates within a security focused architecture where analytical processes are shielded through encryption layers and controlled access logic. Since no transactions are executed, trading capital and sensitive financial credentials remain outside the analytical environment. Continuous system monitoring and verification routines maintain stability while minimizing unnecessary data collection.

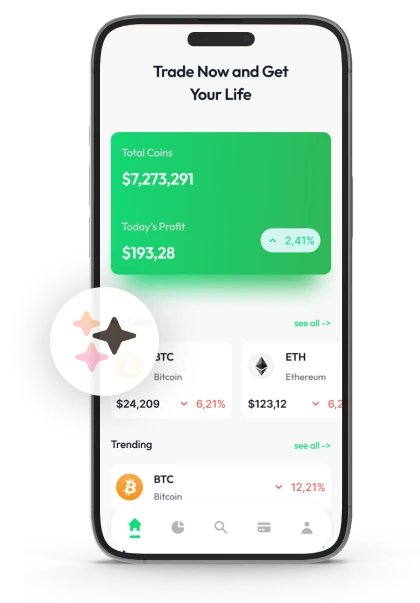

Aura Liquidante displays market behavior through a clean and organized visual structure that highlights key zones trend development and behavioral transitions. Every visual component is generated through algorithmic assessment rather than subjective interpretation. This enables structured comparison strategy testing and observation without emotional distraction.

Instead of relying on past cycles, Aura Liquidante tracks live price behavior as it evolves. Emerging momentum is captured at inception and time stamped precisely. This ensures insights reflect active market energy rather than residual movement from earlier sessions.

Complex activity is refined into focused insight panels that emphasize meaningful structural change. Signals remain aligned with real time conditions allowing momentum shifts to surface clearly. Each insight is filtered to remove delay noise and excess interpretation.

Aura Liquidante refreshes analytical perspective the moment market conditions change. Strength variation liquidity expansion and breakout formation are observed live eliminating reliance on static snapshots. Insights reflect what is happening now not what has already passed.

Rather than releasing raw alerts, Aura Liquidante processes incoming data through confirmed momentum frameworks. Intelligent filtering removes background interference isolating genuine directional behavior. Cryptocurrency markets are highly volatile and losses may occur.

When balance begins to change, Aura Liquidante identifies volume expansion directional rotation and pressure buildup without delay. Continuous scanning ensures awareness remains current and precise.

Aura Liquidante is designed to support efficient interaction through streamlined navigation responsive controls and logical layout. Configuration adjustments and contextual insight access occur without friction supporting focused evaluation.

Aura Liquidante converts complex market pressure into structured intelligence by examining participant behavior reaction triggers and directional flow. Instead of summarizing outcomes the platform reveals how structure is forming in real time.

Incoming information is reorganized into layered momentum analysis creating stability during uneven or sharp movement. This approach supports calm interpretation even during rapid change.

To preserve analytical reliability Aura Liquidante operates within fortified processing environments governed by adaptive system controls. Calculations remain accurate resilient and aligned with live conditions without distortion.

Aura Liquidante detects early momentum development by aligning multiple analytical validation layers such as strength measurement breakout qualification activity region evaluation and depth aware assessment. Signals are released only when defined conditions converge ensuring clarity and consistency without interpretive uncertainty.

Trend behavior is processed through a staged reasoning framework that reviews speed variation directional persistence and repeated trigger alignment together. When decisive pressure elements synchronize minor movement is removed leaving only reliable structural confirmation.

Aura Liquidante reveals emerging market changes before momentum becomes visually apparent. Small variations in speed pressure release and stability are identified immediately allowing alignment with live market development instead of delayed confirmation.

Aura Liquidante adjusts analytical sensitivity to accommodate varying trading styles. Short duration approaches receive fast response insight while longer horizon strategies are supported by stability oriented signals designed for extended evaluation.

Through structured flow assessment Aura Liquidante highlights where momentum begins where energy consolidates and where directional shifts may unfold. Each scenario is weighted logically supporting controlled evaluation and structured planning.

Aura Liquidante analyzes multiple potential market outcomes in parallel aligning projected behavior with defined strategic models. By evaluating trend durability reaction structure and pressure concentration insight quality is strengthened over time. Cryptocurrency markets are highly volatile and losses may occur.

Aura Liquidante converts live price movement into clearly organized market zones through spatial modeling and momentum based analysis. Instead of cluttering charts with excessive detail the system isolates regions where continuation or reversal probability concentrates. When analytical conditions align these zones are elevated for focused review.

The visual structure illustrates how price energy evolves over time. Compression phases rotational behavior and weakening structure are monitored together to show when conviction is building or fading. When alignment strengthens these zones gain analytical credibility and reduce reliance on speculation.

To preserve clarity Aura Liquidante highlights only indicators that demonstrate consistent performance. Visual output adjusts with real time rhythm changes while internal ranking logic evaluates zone relevance. Decision making remains structured and consistent rather than reactive.

Crowd driven reactions rapid narratives and emotional surges often disrupt timing. Aura Liquidante reduces this distortion by measuring participation intensity narrative acceleration and reaction speed across multiple behavioral inputs. Emotional momentum is assessed independently then aligned with live price activity to minimize false signals.

Sentiment behavior is monitored across short and extended time windows capturing sudden emotional reversals early. Both rate of change and intensity are evaluated highlighting conditions where confidence erosion may be developing beneath visible movement.

By integrating sentiment behavior with active price pressure Aura Liquidante delivers balanced market perspective. When emotion and structure diverge alerts trigger immediate reassessment supporting disciplined evaluation.

Digital asset markets often react quickly when global economic conditions evolve. Shifts in inflation direction employment data or growth outlook can redirect capital behavior. Aura Liquidante monitors these developments through an integrated macro analysis layer measuring scale timing and relevance before converting them into structured market context.

Advanced analytical models connect broad economic movement with live crypto price behavior. By comparing historical macro turning points against current structural conditions Aura Liquidante highlights moments when external data meaningfully supports emerging price action. Insights are ranked by relevance and projected influence removing low impact noise.

Aura Liquidante blends automated analytics with rule driven structural evaluation to deliver a refined view of crypto market behavior. The monitoring engine tracks directional flow liquidity regions and fragmented activity alerting unusual developments as they appear.

The system recalibrates continuously prioritizing the most relevant real time signals. Price movement is assessed within a complete contextual framework rather than in isolation ensuring insight reflects genuine market dynamics. The interface remains clear intuitive and fully user controlled.

Small imbalances frequently emerge before major directional moves. Aura Liquidante links subtle pacing changes with historical volatility behavior to generate early alerts supporting structured long or short planning instead of reactive decisions.

Sharp expansions can develop without warning. Aura Liquidante identifies these conditions as they form outlining emerging reaction zones and presenting concise scenario guidance. Each alert explains origin intensity and near term relevance while execution control remains external.

Through continuous structural monitoring Aura Liquidante recognizes early trend behavior and highlights actionable setups before broad participation forms. Pressure accumulation directional flow and potential turning zones are mapped to support anticipation.

Fast shifts can disrupt planning but Aura Liquidante provides consistent structured feedback throughout market change. Standardized reporting and motion evaluation trigger alerts only when behavior demonstrates stability supporting measured response.

Aura Liquidante applies advanced modeling and practical evaluation to uncover underlying price behavior detect order flow stress and highlight high confidence reaction areas. Continuous monitoring of sentiment volume and momentum delivers directional context while all decisions remain manual.

The dynamic signal engine updates instantly maintaining clarity during rapid surges or reversals. In fast moving crypto markets structured reasoning supports risk awareness and disciplined strategy execution.

Aura Liquidante converts fast market data into structured guidance using AI driven dashboards analysis frameworks and strategic templates. The platform does not connect to trading accounts ensuring insight delivery without execution control interference.

Aura Liquidante offers a guided step based experience. Initial interaction begins with simplified visuals and intuitive tools while advanced capabilities such as scenario mapping and metric analysis unlock progressively as familiarity grows.

No. Aura Liquidante does not perform automated trading. Opportunity identification timing evaluation and market context are provided while all execution decisions remain fully manual.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |